When we’re recommending properties for clients to invest in, they’re often buy-off-the-plan investments. There are lots of reasons that “off the plan” investing suits many people, but, as with all investments, there are risks.

I’d like to alleviate the fears around those risks and share with you the pros and cons so that you can make a decision about whether this is an option that works for you.

Firstly, the greatest fear is falling property values. This is understandable and particularly relevant right now as many property markets around the country are in “correction” phase – the phase that always follows a boom. Property values can sometimes drop 10-15% during correction before stabilising. If you buy off the plan during boom then settle during correction, there is a chance your valuation may come in low. We don’t want that, and, we’re not seeing that in our recent settlements.

Whilst we cannot guarantee that values won’t drop, we can do everything in our power to ensure that we’re recommending locations and developments that will hold their value despite the market. We’ve just had a client settle on an apartment in Collingwood, Melbourne that she paid a deposit on two years ago. She settled in March and the valuation came in significantly higher than her purchase price. We’re actually seeing values hold in all the properties that have recently settled, and this all comes down to the research we do before recommending a property.

Other fears that investors can have are interest rate rises and bankruptcy of developer. While there is nothing we can do to lock in interest rates, we can make sure that the numbers on the investment still add up and repayments are still affordable at varying interest rates. We also can’t do anything to guarantee the financial integrity of the developer, but we do a thorough due diligence on every developer that we recommend. We won’t recommend a property if the developer doesn’t have a strong track record and if we’re not confident of their quality and integrity.

Whilst there are risks, there are lots of pros.

Firstly, it’s like a promise. You pay your 5-10% deposit now and then have time to save and arrange finance before exchange. You’ve set a goal to buy an investment property and you’re backing yourself and making that commitment that your goal will be achieved.

The fact that you only need to pay a very low initial capital outlay of 5-10% deposit, yet you’re able to secure a high value asset for a very low initial capital outlay is a good opportunity that you can work to your advantage.

You usually have a greater choice of properties within the development as you’re getting in early. You can pick the best of the best, or the cheapest of the best – or whatever is the option that meets your investing strategy. You have more options and greater choice when you get in early.

You’ve locked in the price. If property values increase, your purchase price is locked in and won’t go up with the property value. You’ve often made a win by settlement date. Research from CoreLogic tells us that correction phases in capital cities usually last 18 – 24 months. If you buy an apartment off the plan now, chances are good that we’ll be in another growth phase by settlement.

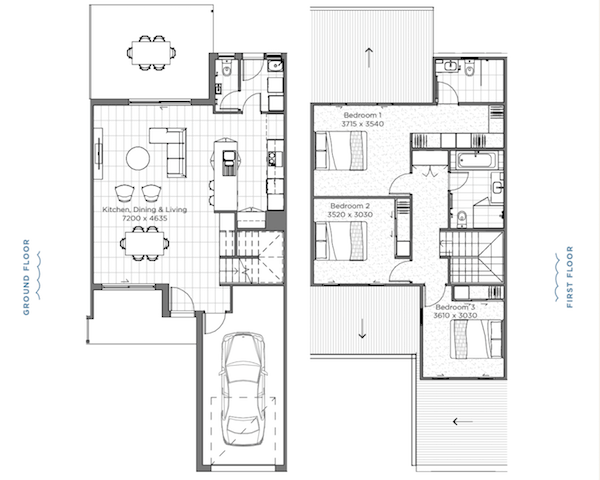

When buying off the plan, you have different timeframes between exchange and settlement. House and land packages are usually 18-24 weeks while apartments can be two years. With house and land, you have significant savings on stamp duty as you only need to pay it on the land component. You do need to arrange finance as you will need a construction loan as well as the loan for the land. You need to make progress payments during construction.

With apartments, you don’t need to have finance in place until the settlement date – which gives you a whole lot of time to prepare and make yourself look great for the lenders.

If you want to invest in property but are concerned about buying off the plan, please get in touch and we can talk through your fears and the options.